An aggressive investor has an affinity towards risk and is willing to accept the higher risk to create opportunities for increased returns. Though age is not a barometer for assessing risk, typically this investor is young, in an early lifecycle stage, or has a long investment horizon. A portfolio with over 60% of assets invested in equities can be considered to be aggressive. Very aggressive asset allocation models can even invest over 90% of the assets in equities.

This Blog is For Sale

Asset allocation model for conservative investors

October 22 , 2020 |4 Comments

Asset Allocation Model For Conservative Investors

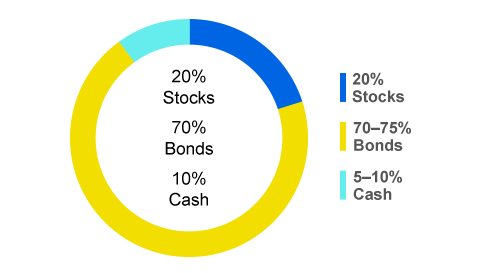

A conservative investor is one whose risk tolerance is low. He is someone who would prefer a low risk-low return scenario. This can also be the case with someone who is moving towards the end of the investment horizon. Such an investor may otherwise be risk tolerant, but his portfolio needs to be rebalanced by lowering the risk as he may be nearing the end of his investment Though there is no thumb rule for the same, a portfolio with over 60% of assets invested in fixed income securities can be considered to be conservative. The equity allocation would generally be 30% or lower.

The Gone Fishin Portfolio And Investment U S Asset Allocation Model

Share this post:

BlogNiche.com

Professional niche blogs with track record over 1M+ blog posts, Still counting.

Connect: View All Posts

0 replies